bae: There are also milestones for investors #DHDL

Founding teams in the fundraising process are well aware of them: Milestones. Here, further payments from investors are often linked to the success of the start-up. But the founders of bae showed on ‘Die Höhle der Löwen’ that it can also work the other way round.

Montag,

28.10.2024

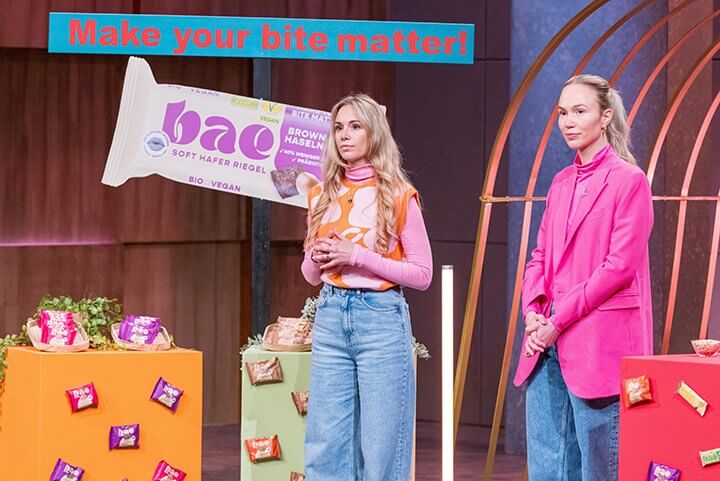

Laura and Lorena were well aware that their product would not immediately excite the lions, as they started their pitch with an alarm signal at the word ‘oat bar’. And of course, there have already been a few bars on the programme, and the shelves are also full of a wide range of different versions of these snacks.

But they also argued that their bars definitely have a USP, because not only do they contain much less sugar and good vegan ingredients. Above all, the young start-up also works with so-called prebiotics, substances that serve as food for the good bacteria in the gut and can therefore help with healthy intestinal flora.

The lions were very impressed by the flavour at least, as both the bars and the previous product already on the market, the ‘Bites’ – creamy filled snack balls – received a lot of praise.

Food Lion Tillmann Schulz also confirmed that products with prebiotics are already widely available in the USA, but not yet in Germany.

However, it was not only their products that were convincing, but also the founders themselves. They had already realised around 60,000 euros in the first three months and appeared extremely competent, but above all charismatic and highly motivated.

This particularly impressed Ralf Dümmel, the lion of commerce, who ultimately cancelled, however, as he already has several start-ups with bars in his portfolio.

The other lions also cancelled one after the other – because they considered the competition to be too big or the product did not appeal to them 100%.

In the end, only Tillman Schulz remained, but he was absolutely delighted. He made the founders an offer and emphasised that he was 120% behind the start-up and saw himself as an ideal addition – but wanted 25% of the company for the 180,000 euros instead of the 20% offered.

The founders conferred and provided a rather funny moment in the programme, because at first it looked like a direct commitment, but when Tillmann Schulz wanted to jump up for the sealing embrace, they put the brakes on him and announced an additional condition.

For the last 5% of his requested shares, the lion was to realise 5000 listings of bae products.

Here, a classic of the startup world has been turned around, as it is usually the startups for which the investment sum is paid out in tranches. In fact, it is common for only the very first instalment – often only a third of the agreed investment sum, for example – to be transferred directly after the investment is signed. All subsequent instalments are linked to so-called ‘milestones’ – these can be, for example, customers reached, turnover or steps in development. Investors thus protect themselves from excessive losses if the startup’s growth or development plans do not work out.

But this also works the other way round: especially when an investor promises high added value beyond the money, founding teams are even well advised to consider how these added values can perhaps be formulated as milestones.

Laura and Lorena from bae did just that. And they also entered this negotiation very cleverly: they reminded Tillmann Schulz of his statement that he would back them 120%. This implies that he naturally intends to do his utmost for the startup anyway and contribute all his added value. The actual fulfilment of his promises to tie the last 5% of his targeted shares should therefore not come as a shock to him.

And the tactic worked, the food lion even liked the move, as it meant he could be sure that the female founders would not be so easily overrun in future negotiations, as they had already proven their negotiating skills.

So the deal was embraced after all, and after the founders left, the lions did not spare any respect for the action – even if the very patriarchal phrase ‘they have balls’ from Tijen Onaran, who is actually known as a feminist pioneer, seems a little strange.

Of course, such an approach can simply be described as courage and good negotiating tactics. But perhaps that’s too short-sighted, because you can also see much more in it: the care and passion to bring your own start-up forward and to find the right comrades-in-arms to do so.

Photo (above): TVNOW / Bernd-Michael Maurer

Ruth Cremer

Ruth Cremer ist Mathematikerin und Beraterin sowie Hochschuldozentin auf dem Gebiet der Geschäftsmodelle, Kennzahlen und Finanzplanung. Als ehemalige Investmentmanagerin weiß sie, worauf Investoren achten und hilft auch bei der Pitch- und Dokumentenerstellung im Investitions- oder Übernahmeprozess. Seit 2017 ist sie als externe Beraterin an der Auswahl und Vorbereitung der Kandidaten in "Die Höhle der Löwen" beteiligt.