Speaker

Ich bin internationale Rednerin im Bereich Startups und Digitalisierung. Mein Lieblingsfeedback: “Ich habe wirklich etwas mitgenommen, das mir direkt weiterhilft!”

Coach

Ein guter Coach sagt Dir nie, was Du machen oder lassen sollst, sondern stellt die richtigen Fragen, damit Du Deinen Weg findest. Lass uns gemeinsam vorwärts gehen!

Workshops

Es soll tiefer gehen? Es gibt Pitch Decks, Finanzpläne oder KPI-Frameworks zu erarbeiten? Oder wird ein Crash-Kurs gebraucht, um bald mit Investoren zu verhandeln? Ich habe die richtigen Workshop-Formate!

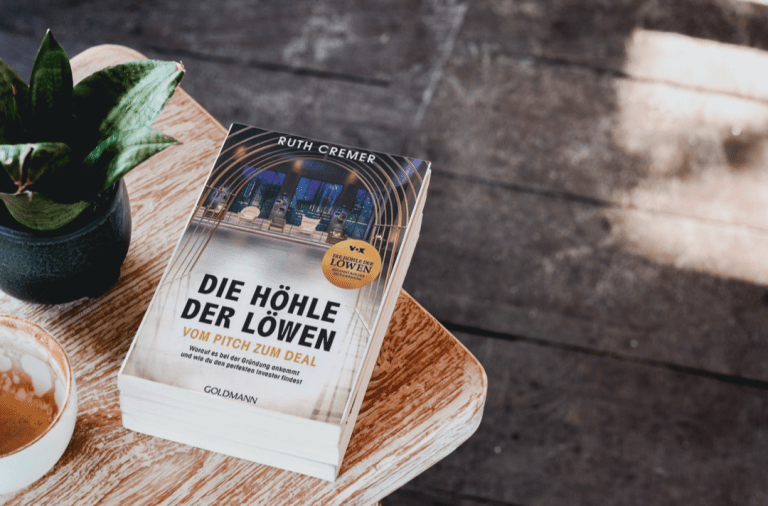

Jetzt erhältlich

VOM PITCH ZUM DEAL

Mein neues Buch über Pitch Decks und Deals, welches ich zusammen mit "Die Höhle der Löwen" geschrieben habe, ist jetzt erhältlich.

Auf Amazon bestellen

Neugierig geworden?

Speaker & Coach

Ruth Cremer

Eins hat zum anderen geführt. Diplom-Mathematikern, ehemaliger Investment Manager, Hochschuldozentin, Beraterin von: “Die Höhle der Löwen”: Meine Leidenschaft für Innovationen und Startups hat mich bisher schon mit weit mehr als 1000 Startups - und auch vielen Investoren - arbeiten lassen, weltweit. Ich habe einen sehr hohen Anspruch an meine Arbeit und lege Wert auf nachhaltiges Wachstum, nicht auf oberflächliche Show-Effekte und leere Versprechen.

Kontaktanfragen / Kontaktmöglichkeit

Nimm gerne Kontakt auf!

Teile mir ein paar Details zu Deiner Anfrage mit und ich und mein Team melden uns schnellstmöglich!

mail@ruthcremer.de