Aktuelles

Blogartikel

Die Bedeutung von Zahlen für Geschäftsmodelle und Investorenverhandlungen.

Wählen Sie ein Thema, um die gewünschten Inhalte schneller zu finden.

TukToro: When KPI juggling is exposed #DHDL

Donnerstag, 19.06.2025

Even if many preachers of storytelling don't like it, investor money - as long as they are competent investors - is not raised through storytelling, but through hard facts and figures. Above all, KPIs are crucial for a good start-up pitch. However, the latest episode of ‘Die Höhle der Löwen’ shows that throwing them around can backfire if they have no basis.

Mon Courage: Can you build a startup remotely? #DHDL

Freitag, 06.06.2025

On Monday's episode of ‘Die Höhle der Löwen’, founder Eva divides the well-known TV investors in several ways: first with regard to her brand, then on the question of whether it makes sense to build a startup while constantly travelling. The majority seem to be of the opinion that this is out of the question for founders. But are there really solid reasons behind this or simply outdated thought patterns?

Patron: When bumpy storytelling distracts from great numbers #DHDL

Freitag, 30.05.2025

The importance of good storytelling is emphasised time and again in startup pitches, even if this is often overestimated when it comes to investors. On Monday's episode of ‘Die Höhle der Löwen’, startup Patron unfortunately learnt that it can backfire if a strong story is simply not understood.

Corridge: How do you build a USP? #DHDL

Freitag, 09.05.2025

You often hear on ‘Die Höhle der Löwen’ that a USP is not strong enough. The famous ‘Unique Selling Point’ simply refers to the unique selling point of a product or other offering in its market. But how strong is strong enough?

Max-Fitness: Why are loans negative for investors? #DHDL

Sonntag, 04.05.2025

The founding team of Max Fitness impressed on Monday's episode of ‘Die Höhle der Löwen’ with brand ambassador Sven Hannawald, a great product and good initial figures. It almost came to a lion battle, but then they mentioned a large loan and at least one lion jumped off again. But why exactly does something like this seem to be a deal-breaker for investors?

bullet point: Early-stage valuation in a nutshell #DHDL

Samstag, 02.11.2024

It is one of the most frequently asked questions when preparing for investor meetings: How do I argue my case for company valuation? Founder Linda from bullet points demonstrates how in the latest episode of ‘Die Höhle der Löwen’.

bae: There are also milestones for investors #DHDL

Montag, 28.10.2024

Founding teams in the fundraising process are well aware of them: Milestones. Here, further payments from investors are often linked to the success of the start-up. But the founders of bae showed on ‘Die Höhle der Löwen’ that it can also work the other way round.

Lanin Labs: The underestimated online business? #DHDL

Freitag, 04.10.2024

Founder Azuka Stekovics' start-up Lanin Labs offers skincare for melanin-rich skin that aims to fill a gap in the market. But is the founder using the wrong sales channel?

RocketTutor: How positive can you talk about your startup? #DHDL

Freitag, 27.09.2024

The anniversary show of ‘Die Höhle der Löwen’ had it all: not only was there another appearance by former lions Frank Thelen and Jochen Schweizer, but there was also probably the highest ‘multiple’ in the show's history: RocketTutor demanded a whopping 680 times its current turnover as a valuation for its maths learning app business. And Carsten Maschmeyer made the deal at a valuation that still corresponded to a multiple of a good 500. Do founders and lions need maths tuition themselves?

Manti Manti: When investors get emotional #DHDL

Freitag, 20.09.2024

Start-ups with high-priced products in particular are often confronted with seemingly unfair criticism. High-priced niches are very interesting, as they often promise good margins and thus allow for rapid growth and then perhaps expansion into other price ranges.

Ratzfatz: The right way to deal with unit economics #DHDL

Freitag, 13.09.2024

Ratzfatz offers healthy frozen meals for children in order to take the pressure off parents in their everyday lives despite the high demands placed on their children's diet. The lions were enthusiastic about the founders, despite a very critical discussion about important key figures.

Better be Bold: The fine line of self-presentation #DHDL

Mittwoch, 29.05.2024

Many founders find it difficult not to openly communicate the weaknesses of their business, as things like SWOT analysis are still taught as the non-plus-ultra of management, especially in traditional business studies programmes.

Noac: How full can a cap table be? #DHDL

Mittwoch, 15.05.2024

It's not just something you've heard many times on "Die Höhle der Löwen", but all other founders who have ever been looking for investors are probably familiar with the critical questions about the cap table. How many parties hold shares in the company, how many investors are there, how many founders? Investment talks can also fail if the structure is unfortunate. The start-up around the innovative surgical robotics "Noac" also had to realise that they are probably not so favourably positioned here.

Bionic: The difficult decision of the licence business #DHDL

Freitag, 10.05.2024

In many cases, it seems clear what the best business model should look like. The product type, market, target group or the interplay of such factors often dictate at least the cornerstones from the outset. Sometimes, however, there are several options, and a decision in favour of a particular business model has a lot to do with your own values and ideas, but also with your ambitions. Just how difficult such a decision can be is demonstrated by the start-up C-bionic in "Die Höhle der Löwen".

Gelato Pack: the importance of early numbers #DHDL

Freitag, 03.05.2024

It is by no means only in "Die Höhle der Löwen", but also outside of it, that the vast majority of start-ups find it difficult to get a major investment before they enter the market. Andreas, founder of the innovative ice cream packaging Gelato Pack, also had to learn that investors want figures, even if they are still so early. But is it really just about turnover or something completely different?

Nutriomix: Have they done the maths without the (end) customers? #DHDL

Mittwoch, 24.04.2024

A complete investor pitch always includes a market slide. In "Die Höhle der Löwen", however, the market section is not part of the pitch, but has to be asked by the lions afterwards. In the case of Nutriomix, viewers were given a pretty good insight into an exciting industry. Food retail in a nutshell, so to speak.

Pee&Bob: When founder and investor are fans of each other #DHDL

Donnerstag, 18.04.2024

Right after the pitch, praises showered down as Pee & Bob's founder, Anna Wirsching, delivered her presentation with such joy and zeal that all five 'Lions' themselves were beaming competitively. She captivates without artificial storytelling, excites without painting exaggerated visions.

Casablanca: Of hypes and warning signs #DHDL

Freitag, 12.04.2024

There are always hypes in the start-up scene - trend topics in which almost all large and numerous smaller investors want to invest. The eScooter is probably one of them, as are online supermarkets and now artificial intelligence. Sometimes they are justified, sometimes not. But such hypes always play a special role in the fabric of the scene, which can also lead to completely different effects. As in the case of Casablanca in the first episode of the new season of "Die Höhle der Löwen".

Molly Suh and the dreaded corporate argument #DHDL

Freitag, 15.12.2023

Almost everyone who has ever been to a pitch event where there was also a kind of jury knows the question: what would the small start-up do if a corporate giant decided to copy their product? But is there a clever answer?

Zeedz: Why games are all about numbers #DHDL

Donnerstag, 19.10.2023

The current season of "Die Höhle der Löwen" came to a brilliant conclusion with a mega deal for "Zeedz". And this despite the fact that investments in a game are considered quite difficult and many investors rule them out completely. What is so special here that everything seems to be different?

BIOTherma-Pad: Is there a „wrong phase“ for finding investors? #DHDL

Donnerstag, 12.10.2023

Founder Friederike Freifrau von Rodde ventured before the lions with her BIOTherma-Pad. However, she had to admit that the product was not yet ready. How can you still convince investors, even if you're a bit early?

TheBlood: Economies of scale or high scalability? #DHDL

Mittwoch, 27.09.2023

Women's health is a huge market that is only just being de-tabooed and tapped. The start-up TheBlood, which appeared on "Die Höhle der Löwen", has also set out to push this further. But is their model really as "highly scalable" as they claim?

Urban Challenger: Why many investors like repeat founders #DHDL

Mittwoch, 20.09.2023

For most early-stage founders, it is super impressive when they hear that someone has sold their startup for a large sum. But is someone like that still suitably motivated for their next start-up? The opinions of the TV lions are not the only ones that differ.

natch: When can you base a rating on a forecast? #DHDL

Mittwoch, 13.09.2023

In the third episode of the current season of "Die Höhle der Löwen" there was once again plenty of criticism of a rating. But the founders had actually come up with a derivation. Why was this not convincing?

FreeMOM: Haggling over shares steals the stage from the groundbreaking concept #DHDL

Dienstag, 05.09.2023

The second episode of the 14th season of "Die Höhle der Löwen" also had a lot to offer. For example, FreeMOM was presented as a concept that not only questions fundamental structures in the labour market, but could also change them permanently. But the disruptive character of the model is unfortunately completely lost.

Mitmalfilm and the cryptic refusals of the lions #DHDL

Mittwoch, 30.08.2023

Sometimes what a start-up does is just beautiful. The new season of "Die Höhle der Löwen" has just such a theme again with the young company "Mitmalfilm", because here children can have their own drawing become the background of a cartoon film. Unfortunately, however, the figures do not seem to be convincing in certain respects. But what exactly is behind the sometimes somewhat cryptic cancellations by the lions?

eSelly: When not to think directly about earning money #DHDL

Freitag, 12.05.2023

In "Die Höhle der Löwen", the questions about turnover and earnings of the young companies are among the most important. Often not included in the finished version, but just as important are the numerical questions aimed at determining when the start-up in question might be able to earn money. But sometimes everything is different. The example of eSelly was a good illustration of the requirements that have to be met by investors for such a special case.

Brilamo: Hero of the day with unagitated competence instead of visionary poseurism #DHDL

Mittwoch, 26.04.2023

You know them well - the overconfident, visionary, sometimes slightly hyperactive founders who talk about great plans, have optimised their storytelling down to the last detail - but then also demand very self-confident assessments from investors. But on this Monday, Linda from Brilamo showed us that you can also make investors rave in a completely different way - and was overwhelmed with superlatives. Is this the new type of founder that can become a role model?

Tinus: Milestones also exist for investors #DHDL

Mittwoch, 19.04.2023

Many founders are very familiar with so-called milestones in an investment. But almost all of them associate them with the fact that their start-up has to achieve certain goals in order to continue receiving money from investors. But it also works the other way around. In the latest episode of "Die Höhle der Löwen", you can see very well how something like this can work, using the example of the start-up Tinus from Munich.

NewMa: A previously ignored market #DHDL

Donnerstag, 13.04.2023

Many new markets arose because someone noticed a problem and wanted to solve it. Such a market grew particularly quickly if the problem was not insignificant - i.e. caused a certain amount of suffering - and was relevant to as large a number of people as possible. The pain and problems that most women experience after childbirth actually fit right in, yet they have been offered solutions that don't really deserve the name. How could it be that such a large and willing-to-pay market has simply been ignored until now?

Zahlen-Wahrheit: Was wirklich schief läuft mit den Lebensmittel-Preisen

Mittwoch, 18.01.2023

Trotz allem Gehype um Storytelling sind es oft die Zahlen, die erstaunliche Wahrheiten beinhalten. Und nach hunderten Coachings mit Startups aus dem Lebensmittelbereich würde ich behaupten, hier eine ganz gute Datenbasis zu haben. Mit dieser im Hinterkopf ist ein Blick auf die aktuelle Preissituation einfach nur erschreckend. Denn wieder einmal scheinen wir Menschen von den großen Konzernen einfach nur verarscht - man muss es leider so deutlich sagen - zu werden.

Mathe-Bashing und seine Folgen – auch für die Startup-Welt

Freitag, 13.01.2023

Der folgende, für viele vielleicht lustige Post hat mich gestern schwer schockiert.

Immer wieder erlebe ich es auch in der Startup-Szene - diese Aversität gegenüber allem, was mit Zahlen zu tun hat. Dabei, habe ich das Gefühl, ist es gar nicht die Mathematik selber, die die Leute abschreckt. Denn eine Zahl durch eine andere teilen, das wird ja nun noch jeder - notfalls mit Taschenrechner - hinbekommen.

Doch das logische Denken scheint es, was aus der Mode geraten ist - Zusammenhänge herzustellen, aus einer Sache eine andere abzuleiten. Doch Investoren kehren sich gerade immer stärker ab vom großartigen Storytelling - und hin zu bodenständigeren, schneller wirtschaftlich tragbaren Geschäftsmodellen. Und wie bewerte sie das - genau, mit Zahlen.

Papydo: Why the elbow-less form of negotiation makes more sense for start-ups (and investors) #DHDL

Mittwoch, 14.12.2022

On both the startup and investor side, there is still a strong attitude that negotiations have to be tough. Many founders in particular believe that going in with a slightly higher valuation and then wrestling for every percentage point is simply part of the game. Investors, on the other hand, sometimes seem to see it as one of their core tasks to negotiate founders down a bit more in any case. But is this time-honoured, very patriarchal way of negotiating really the right one in this setup? In the Christmas episode of "Die Höhle der Löwen", the founders of Papydo show how things can be done differently. Why this could and should set a precedent.

Werte statt Labels! Warum ich einen Wurm gegessen habe

Dienstag, 13.12.2022

Es ist schön, Begriffe zu haben, die einem helfen, sich zu orientieren. Oder komplexe Zusammenhänge besser verständlich machen. Doch wenn es nur noch um die Labels geht, um das, was außen drauf steht, dann läuft etwas gehörig schief.

On the edge: Kommt jetzt der große Investment-Winter für deutsche Startups?

Donnerstag, 08.12.2022

In den letzten Wochen und Monaten habe ich es so oft gehört und gelesen, dass es schon fast langweilig wird: Angeblich kommt jetzt die große Depression von Startup Investments, Die fetten Jahre, wo man einfach so ein paar Millionen bekommt, die sind vorbei, heißt es überall. Gleichzeitig führen für die Allgemeinheit unverständliche VC-Investments zu Verwirrung. Für mich also Zeit, zu reagieren und zu versuchen, ein wenig Licht ins Dunkel zu bringen ;-)

Deutsche Event-Organisatoren: Hört endlich auf, Frauen zu verleugnen!

Dienstag, 15.11.2022

Besucht man in Deutschland ein Startup-Event, findet man häufig ein recht diverses Publikum - auf der Bühne aber größtenteils Männer. Was in anderen westlichen Ländern einen Shitstorm auslösen würde, wird hierzulande mit dem Totschlag-Argument “Es gibt ja so wenige!” bei Seite gewischt. Und bei allen Diskussionen um Gendern und Quoten scheinen wir überhaupt nicht zu merken, wo und vor allem wie stark in unserem Land wirklich diskriminiert wird.

Der Funnel: So viel mehr als ein Hobby der Marketing-Spezialisten

Dienstag, 25.10.2022

Es wird Zeit. Zeit für mein Lieblingsthema. Ein Thema, das in so vielen meiner Vorträge vorkommt, und wirklich in jedem meiner Workshops. Egal, ob Geschäftsmodellentwicklung, Finanzplanung oder Pitch-Training. Für die einen ist es nur Marketing, für mich ist es ein Ansatzpunkt, um ein Geschäftsmodell so richtig auseinanderzunehmen. Und manchmal die GründerInnen gleich mit. Natürlich nur, um nachher alles viel besser wieder zusammenzusetzen ;-)

Standsome: Product before numbers doesn’t pay off #DHDL

Donnerstag, 20.10.2022

You can make many mistakes when pitching and talking to investors. But some are made much more often than others. In the final episode of the 12th season of "Die Höhle der Löwen", one of the most common could be observed.

Taste like: The taste is convincing, but the logistics are not #DHDL

Mittwoch, 12.10.2022

Start-ups always have to deal with issues that do not exist for established companies. Especially in the food sector, there can be challenges that make it very difficult to "just find" a producer to produce the products that have already been very successful at trade fairs or food events in sufficiently large quantities for the retail trade. In the 7th episode of the 12th season of "Die Höhle der Löwen", some of these issues came up in the case of "Taste like". Exciting for the viewers, but especially for all founders who have similar plans.

Die fragwürdigen Angebote der Online-Coaches – Warum Du es so garantiert nicht schaffst und wie es viel eher klappt

Dienstag, 11.10.2022

Irgendwie scheine ich in deren Targeting zu sein - denn ständig bekomme ich Werbung von selbsternannten Super-Coaches angezeigt, die mir entweder zeigen wollen, wie ich mein Business auf einen sechsstelligen Umsatz im Monat “skalieren” kann oder wie ich mir ein “passives Einkommen” aufbaue und fortan vollautomatisch Geld scheffle, während ich in einer Südsee-Hängematte die Füße hochlege. Irgendwann habe ich mich aus Neugier mal nach deren Preisen für ihre angeblich wasserdichten Schritt-für-Schritt-Programme erkundigt, und bin aus allen Wolken gefallen. Grund genug für mich, ihre häufigsten Versprechen einmal gründlich auseinanderzunehmen.

Warum so etwas also nicht klappen kann - und wie Du es stattdessen angehen solltest.

ichó: An emotional topic, but difficult numbers #DHDL

Freitag, 07.10.2022

A prominent advocate and investor, a highly emotional and important topic that moved several lions to tears at once, and promising initial results: ichó's training system, which is supposed to help dementia patients at least delay the disease, really left no one cold during its appearance on "Die Höhle der Löwen". In the end, however, there wasn't even an offer, let alone a deal. What didn't fit?

“Wie finde ich bloß die richtige Gründungsidee?”

Dienstag, 04.10.2022

Welche Möglichkeiten es gibt auf dem Weg zur Idee und warum die alleine noch nichts wert ist

Hattest du sie schon, DIE eine Idee, die dein Leben verändern soll? Oder wartest du noch auf sie? Versuchst du aktiv, ihr auf die Schliche zu kommen, oder hat sie dich eines Tages einfach getroffen?

Und was dann? In der Startup-Welt heißt es immer, man soll sich möglichst viel Feedback einholen. Aber kann das nicht auch schaden, wenn man an Leute gerät, die eine falsche Vorstellung von dem bekommen, was man ihnen erzählt? Muss eine Idee eine bestimmte Reife haben, um sie zu pitchen?

Aller Anfang ist schwer, deswegen gibt es hier für dich ein paar Tipps für deine allerersten Schritte in die Gründungswelt.

CleverCakes: With numbers to success #DHDL

Mittwoch, 28.09.2022

No area of founders' knowledge and skills seems as neglected as numbers. And although investors - not only on "Die Höhle der Löwen" - never tire of stressing how important it is to know and communicate the most important figures of one's business, start-up events and trainings prefer to emphasise storytelling. In the 5th episode of the 12th season, however, founder Elina flashed the lions all along the line, but above all with her numbers. And thus shows how it's done right.

Macht es richtig, oder lasst es!

Dienstag, 27.09.2022

Warum so viele Startups ihre Zeit mit eigentlich tollen Tools verschwenden

Eigentlich haben wir es verdammt gut. Eigentlich. Denn wir haben großartige Tools, die wir für unsere Startups nutzen können. Die uns helfen können, all die vielen Baustellen, mit und auf denen wir arbeiten müssen, zu überblicken, saubere Prozesse mitten im Chaos zu definieren und uns generell voranbringen. Das Business Model Canvas ist so ein Tool, oder auch die Lean-Startup-Methodologie. Doch irgendwie werden sie oft nur sehr oberflächlich gelehrt, und demzufolge dann falsch benutzt. Warum du es dann aber gleich ganz lassen kannst und wie du es richtig machst.

Hyrise Academy: When Startups fill the education gap #DHDL

Donnerstag, 22.09.2022

Our school and vocational training system unfortunately very often misses the actual need. In the meantime, there is a glaring shortage of skilled workers in many areas on the one hand, but no quick and high-quality education or training opportunities for those interested. This is the case with software salespeople. Dominik and Michael from Hyrise are remedying this situation. And obviously highly successfully.

Meine Big News: Warum Gründungswissen in Deutschland so schlecht ist und was ich dagegen tun will

Dienstag, 20.09.2022

Ich bin es wirklich satt. Die Blender und Poser, die so tun, als ob sie wüssten, wie es ginge, aber keine Ahnung von Startups haben und so viel kaputt machen. Die Politiker, die sich damit schmücken wollen, weil es "cool" und "hipp" ist, irgendwas mit Startups und Innovationen zu machen. Und doch einfach mal gar nichts voranbringen.

In über 10 Jahren habe ich viel gesehen. Aber auch viel gelernt, was hilft und was schadet. Ersteres mache ich jetzt einfach. Unter neuem Namen, mit neuem Firmenzweck und neuen Ideen. Handfestes Wissen für GründerInnen. Mit Spaß. Meckern UND was dagegen tun sozusagen ;-)

Next Folder: German bureaucracy vs. young founders? #DHDL

Donnerstag, 15.09.2022

In the latest episode of "Die Höhle der Löwen", viewers once again got to see something that is no longer all that rare in the start-up show - as it is in the start-up world in general: very young founders. Johannes and Valentin had also started their start-up idea before they were legally of age. But since that is not possible in Germany, their grandmother had to found the company for them. You can think that's sweet, but actually it's just sad.

Work-Life-Balance für GründerInnen – Wie du als Startup-GründerIn Leben und Arbeit in Einklang bringst

Dienstag, 13.09.2022

„Du arbeitest gar nicht wirklich, wenn du tust, was du liebst“ heißt es doch so oft. Doch das ist leider totaler Quatsch. Hast du dich schon einmal so richtig ausgebrannt gefühlt? Eine gesunde Balance zwischen Privatleben und Arbeit zu schaffen, ist für dich als GründerIn sicherlich nicht immer einfach. Auch mir ist nach einer schwierigen gesundheitlichen Phase wieder einmal klar geworden, wie wichtig es aber ist und wie schlecht ich mich teilweise um mich selbst gekümmert habe. Ich habe daher ein paar Anregungen, die ich dir mit auf den Weg geben möchte, damit du deine Balance halten kannst!

Nippli: Customer problems don’t have to be politically correct #DHDL

Donnerstag, 08.09.2022

No sooner was the participation of the founder of Nippli in "Die Höhle der Löwen" announced and her product idea made public than there was the first gloating and the first small uproar on the net. Why should women necessarily make their nipples invisible? But she doesn't say that at all, has not only women as her target group anyway and her sales figures clearly speak the language of market acceptance. A plea for less idea-focusedness.

Pagopace: The power of use cases #DHDL

Donnerstag, 08.09.2022

The founders of the payment ring start-up Pagopace experienced a real rollercoaster ride in "Die Höhle der Löwen". From total enthusiasm to great scepticism to tough negotiation. But in the end they succeeded, at least some of the investors' euphoria lasted until the end. How do you do it?

Da bin ich wieder – same same but different

Mittwoch, 07.09.2022

Dem ein oder anderen ist vielleicht aufgefallen, dass ich eine Weile fast abgetaucht bin. Außer vereinzelten Posts über Events, auf denen ich aufgetreten bin und Podcasts, wo ich zu Gast war, war nicht viel von mir zu hören.

Das war nicht, weil ich nichts mehr zu sagen habe, auf gar keinen Fall. Wer mich kennt, würde diesen Verdacht wohl auch nie äußern ;-)

Herr Lauterbach, KI-Dosis gefällig?

Dienstag, 24.05.2022

Wenn man zu viel Zeit hat, denkt man auch zu viel nach. In meinem Fall über Staatsausgaben, über vergessene Startups und eine drohende Klimakatastrophe, für die irgendwie nie jemand Zeit zu haben scheint. Eine Resümee eines krankheitsbedingt sehr ausführlich ausgefallenen Nachrichten-Scrollings.

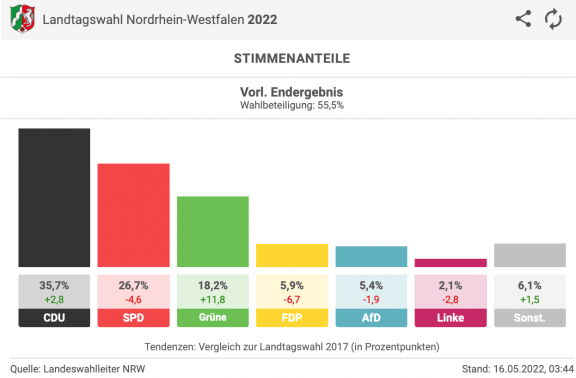

Liebe Grüne, bitte denkt (auch) an Eure Wähler!

Dienstag, 24.05.2022

Mein Shampoo ist ein Klotz, mein Tagescreme aus Kaffee-Resten hergestellt, meine Kosmetik vegan, meine Milch nicht von der Kuh und mein Spülschwamm eine Gurke.

Eigentlich klar, wen ich da wähle, könnte man meinen. Und dann bin ich auch noch Millennial, wohne in der Stadt und kann mir das eine oder andere Extra leisten. Prädestinierte Grünen-Wählerin, könnte man meinen. Aber so einfach ist das nicht.

Iss doch wurscht: A Corona nightmare with a happy ending #DHDL

Dienstag, 19.10.2021

A case that revealed the abysses of the Corona measures. An entrepreneur who had the rug pulled out from under him. But despite all official promises, the state and the banks left him completely alone. But who simply did not want to give up. And finally turned everything around once again.

Fun with Balls/Lymb.io: The Corona Crisis Factor in Valuation #DHDL

Mittwoch, 06.10.2021

The anti-Corona measures have also often hit start-ups especially hard. Those that were able to survive the months-long closures of entire sectors by adapting quickly then often needed the next round of financing sooner than planned. But most of them are worse off at that point. So how does one deal with such a collapse in turnover through no fault of one's own when it comes to valuation?

STUR: The role of crowdfunding in the rating process #DHDL

Mittwoch, 29.09.2021

The 4th episode of the anniversary season of "Die Höhle der Löwen" was not only special in terms of the guest lions and former candidates from Ankerkraut. The founders also had a lot to offer. For example, the pan developers from STUR came up with considerable order quantities from crowdfunding. But they failed in the evaluation discussion, because the lions did not want to equate the crowdfunding income with normal turnover. Reason enough to ask why investors think this way and what crowdfunding is actually worth when it comes to valuation.

independesk: Right reasoning despite strange advice #DHDL

Dienstag, 21.09.2021

In the case of the workplace-sharing platform "independesk", one could witness one of the strangest phone calls ever made in "Die Höhle der Löwen". Nevertheless, it ended well for the founder, because he finally brought the argument that made the most sense in his situation.

KOHPA: When even the biggest storm doesn’t endanger the calm #DHDL

Dienstag, 14.09.2021

In the 2nd episode of the anniversary season of "Die Höhle der Löwen" (The Lion's Den) one can observe extremely opposing opinions of the investors: While one strongly doubts the harmfulness of electro-magnetic radiation and thus the sense of one of two presented products, for the other it is almost too good to be true. But how can one behave in such a situation when the core of one's own product is the center of the discussion? The KOHPA founders successfully demonstrate this.

Classplash: Too much future in the valuation #DHDL

Donnerstag, 09.09.2021

Early-stage startups in particular need to base their valuation to a large extent on future prospects. That is why financial planning is so important. This is where the investor sees where the figures come from and tries to assess how realistic it all is. This is where the opinions between the startup and the investor often diverge. In the case of Classplash, DHDL viewers also had the opportunity to experience such a discussion.

Munevo: When investors want to invest but cannot #DHDL

Montag, 28.06.2021

The Munich-based founders of Munevo achieved what many candidates dream of when they go on “Die Höhle der Löwen”: they astonished the lions, caused goose bumps and repeatedly received the respect of the experienced investors. But in the end it wasn't enough for a deal. What was the reason?

Zaunkönig: A new player in a „crazy market“ #DHDL

Dienstag, 15.06.2021

Even before the pitch, the lions were overflowing with superlatives about the gaming market. The backdrop of the start-up Zaunkönig left no doubt as to what the pitch would be about. But such an exciting market also harbours dangers, as became clear a little later. So even a start-up in the gaming sector has to offer a lot more.

Click’n’Tree: The Right Founder for „Caritalism“ #DHDL

Mittwoch, 09.06.2021

The last start-up to be broadcasted in season 9 of "Die Höhle der Löwen" has it all over again: a not-so-simple business model that first has to be explained. A lion offer that has never existed before. An investor who is breaking new ground. And finally, a lion who drops out in order to enter a battle of the combined offers with another lion at the end.

Lambus: Almost a Silicon Valley start-up #DHDL

Mittwoch, 02.06.2021

A good team, a high willingness to take risks, but no entrepreneurs. A lot of potential, but no precise planning. Hardly any turnover, but good user numbers. And a business model that is not yet fully developed, but a high valuation. Many German founders probably think "USA" here. And indeed, the main founder of Lambus worked in Silicon Valley for four years. Can two such different start-up cultures be brought together?

Evertree: A subject close to our hearts – and one of regularities #DHDL

Mittwoch, 26.05.2021

As broad as the range of topics discussed in "Die Höhle der Löwen" usually is, rarely have the two main topics in the dialogue between founders and investors been so contradictory. On the one hand, the emotionality of the topic - on the other hand, the big question about the existing regulations that significantly determine the market. But the founders managed the balancing act.

Primoza: Everything fits but with no investor #DHDL

Dienstag, 04.05.2021

Founders often think that if they don't get investment, they did something "wrong" in the pitch or in the negotiation. But as the case of Primoza with its “growing calendar” shows, this is not necessarily the case, because sometimes it just doesn't fit. For one it might be the sales channels, for another the topic itself. But what else could be behind the reasons for rejection?

Steadify: It won’t work without numbers #DHDL

Dienstag, 27.04.2021

The start was good, the portable tripod was particularly well received by amateur photographer Dagmar Wöhrl. The Q&A session also got off to a promising start, but then the talk turned to the figures and the dream of a lion deal was shattered. The founders were surprised by the details of the questions. But did the lions really "corner" the founders?

MyEy: A market too niche or a really exciting market after all #DHDL

Dienstag, 20.04.2021

The big plan: to finally send chicken on permanent holiday, to abolish battery cages as far as possible. But at first things didn't look so good for master confectioner and baker Chris Geiser. The taste of his vegan egg substitute was not really convincing as a fried egg. Dr. Georg Kofler then thought the market was too niche. But the tide turned and finally, there were two offers. Why were the other lions convinced by the market?

rePAQ: When a breakthrough product alone is not enough #DHDL

Mittwoch, 14.04.2021

Rarely do you see all the lions so unanimously enthusiastic as in the case of rePAQ, Ralf Dümmel even took a bow. But at a certain point the mood seemed to tilt a bit and in the end they couldn't agree on a deal with the founders. What was it that was missing, alt-hough the topic had carried everyone away from the beginning?

NUI Cosmetics: Advanced brand building #DHDL

Dienstag, 09.02.2021

NUI founder Swantje was extremely keen to make a deal and finally accepted Judith William’s offer. But instead of 20%, she had to give up 40% of her company. And that despite a turnover of over 1 million euros. How and why did this happen?

Soummé: When weaknesses become strengths #DHDL

Dienstag, 09.02.2021

It is a widespread misconception that investors only want to see "perfect" figures and otherwise do not invest. When negotiating with investors, it is much more important as a founder to show that you have your company under control.

Skills4School shows that entrepreneurs can be found everywhere #DHDL

Dienstag, 09.02.2021

When investors are really impressed by a founder, the phrase "That's a good founder" often comes up. But what exactly do they mean by that, and, more importantly, how do you get them to talk like that about you?